ESPORTS BETTING REPORT

OCTOBER 2025

TABLE OF CONTENTS

- Introduction

- An Intro To Esports

- Esports Biggest Titles

- Intro to Esports Betting

- Skin Betting

- Real Money Betting

- Current Esports Betting

- Viewership Numbers

- Pandemic Betting Figures

- Future For Esports Betting

- Alternative Betting

- Challenges For Esports Betting

- Esports Betting Demographics

- Regulation Change

- Summary

INTRODUCTION

Across all sporting events, there is often one constant familiarity – a large and easily accessible betting market. Some bigger events rely on this market as a judge of success such as those found in combat sports, where others use it as an additional activity with esports fitting in to the latter.

This report will aim to take a look at the emergence and growth of esports over the past two decades, the growth and spread of the esports betting market during that time and what future predictions could have in store for esports betting.

AN INTRO TO ESPORTS

The term “esports” had first been introduced in the late 70’s and early 80’s as arcades and other consoles were growing in popularity, but there hadn’t really been any development in the space that could really define it as a sport with the support for professional athletes or teams until the early 2000’s with the development of titles such as Starcraft in Asia and the rising popularity of Counter Strike across Europe.

In many ways, these early offerings couldn’t be considered a huge success – the games were often very niche and had a much smaller audience during the earlier years, players weren’t paid and tournaments were often much smaller as a hobbyist activity once or twice a year. The development in the space has largely started to progress over the past decade – but the movement within esports during that time has been enormous.

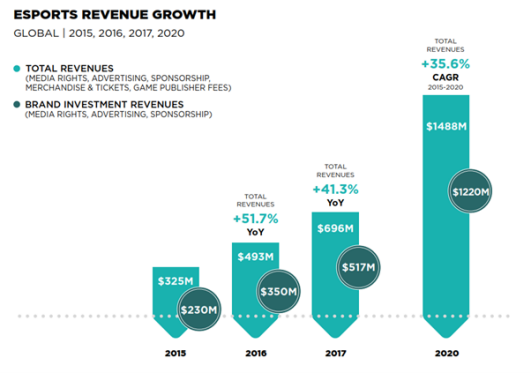

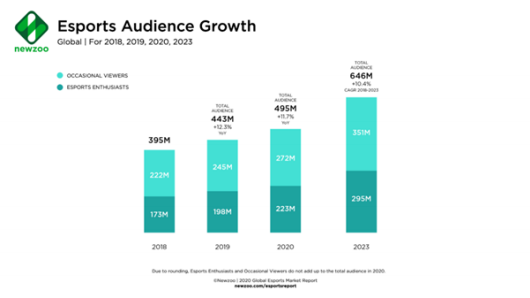

The numbers certainly paint a clear picture – as viewership and interest rose, the revenue grew quickly alongside it with the current year showing just where the revenues are placed. It can often be difficult to paint the full picture with the numbers – Asia remains one of the biggest markets for esports in the world with China being one of the biggest contributions, however not all sources can be fully accounted for and as such these numbers may in fact be much higher than what is reported.

ESPORTS BIGGEST TITLES

To understand the growing esports industry and the betting market that has grown alongside it, it’s important to understand the biggest titles that have pushed this growth and how they’ve affected each market individually. Currently the majority contribution is made by the three big titles of Counter-Strike, League of Legends, and DoTA, but there are some notable names that have played a huge role.

League of Legends is widely regarded as the biggest esports title currently, and it shows by being the most bet event too. Launched in 2009 by developer Riot Games, it had joined another big name at the time in Heroes of Newerth to help redefine the multiplayer online battle arena genre. In order to develop a competitive environment, the game had went a different direction to those before however – prior to the release, most titles had typically relied on a circuit style for events where different third-parties would host larger LAN parties and attract teams that way, whilst the more successful teams could afford to travel internationally, most were hosted for the local teams to attend. League of Legends instead focussed on building an internal broadcasting infrastructure with a seasonal league and playoff structure – each region would receive its own league, teams and players would be compensated if they were able to qualify and participate, and it brought the League of Legends esport as a whole under one roof. The game has often been credited as being the reason for the growth of esports in North America which had previously been underrepresented, but has been extremely successful in Asia and has a very healthy European scene too.

The second of the big three is within Defense of the Ancients 2 (or DoTA2) – the original was launched as a mod for the popular game Warcraft III, and gave the base for other games like League of Legends to develop. The fully developed sequel wasn’t launched until 2013 however by publisher Valve, and in part used the League of Legends blueprint to succeed. Whilst it was able to capture a loyal audience who remained fans of the original game, it was able to capture many looking to jump on the growing MOBA trend. DoTA2 does still rely on a large circuit for events, but each year the developer hosts the largest tournament of the year in The International which invites the best teams from around the world. What DoTA did different however is introduce a system for players to obtain ingame cosmetic items, with the money generated going directly to the prize pool at The International, and leading the game to have the largest pot available of any esport to date. In 2019, with player contributions and the developer set amount too, the event managed to offer a total prize pool of $34,330,068 with the winning team taking the majority share of that for a total of $15,620,181. The young athletes that were now competing were no longer playing for a few hundred dollars as a grand prize, but now stretching in to the millions.

The last of the big three is Counter-Strike: Global Offensive. The game can often be considered as the grandfather of esports alongside one other title, initially being launched as a mod for the popular game Half-Life, it had found a full release as a title in 1999 with the most played version at the time being released one year later. Counter-Strike was able to do for Europe what League of Legends had done for North America, and had quickly become the hub for Counter-Strike 1.6. In 2004, the audience became fragmented however as a newer version of the game, Counter-Strike: Source, was released – this split the core audience of the game into fans and players of version 1.6, and fans and players of Source. This problem was solved in 2012 with the release of the latest version, Global Offensive, which set to unite both audiences and give the game a more global audience – whilst it was successful in achieving this, Counter-Strike is often more widely known for being the catalyst to start the esports betting scene.

One of the games represented in the chart is an honourable mention too – Starcraft II. Before the release of the big three modern titles, Starcraft had largely been considered as the biggest and most successful esports title to date – the scene was largely made up of Asian players hailing from Korea and China, but some international players were able to climb the ranks. Fast gameplay with intense focus and lots of macro and micro play was required to become one of the worlds best contenders, but it had been the first game to offer competitive salaries and bonuses to young players so that they could forgo a regular working job and instead solely focus on playing the game – similarly it was also the game that kickstarted the trend of a team house, where multiple players would live together in accommodation owned by an orginisation, something that is still used now.

INTRO TO ESPORTS BETTING

With an understanding of which titles make up the esports market, it’s easier to understand which titles have been responsible for the growth of the betting market. However, betting hasn’t always been present in the more familiar way that is known across other sporting events and has taken on a different form – the more traditional betting practice has only really found a footing and growth over the past four years or so, with earlier forms looking much different.

SKIN BETTING

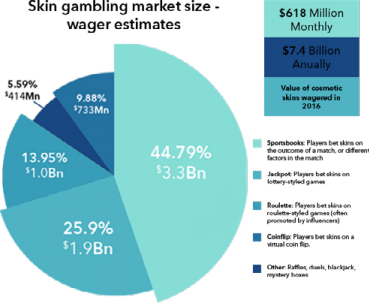

If you’re just getting into Esports betting you may have at one time heard the term skin betting and may be wondering what this means, and whilst skin betting still exists in a small way it largely refers to a point in time before regular betting gained popularity. In 2013, Valve, the game developer behind the popular Esports title Counter-Strike: Global Offensive, introduced the Arms Deal update to the game – this update allowed players to have a chance to receive an in-game item once the game had ended in the form of a “weapon crate” with the choice to then purchase a key to open a cosmetic weapon appearance that could be used in game. With an existing marketplace on the platform, these weapons of various rarities quickly established a real-world value as they could be bought and sold virtually and led to the huge trading scene within the game.

With a real-world value being assigned to these cosmetic items and the ability to trade them, it quickly led to the establishment of a number of sites that allowed players to deposit their weapons as a bet, with the pay-out received also coming in the way of skins – these could then be sold on the online marketplace or used to be traded for higher tier cosmetic items – much of this had been automated by bots as the trading system was fairly straight forward but issues with the system were quickly discovered. At the time many players were playing as a hobby with prize money from tournaments often being the only income they’d have from playing with skin betting providing an opportunity for different – in 2014 the North American team iBUYPOWER had lost a game that they had been favoured to win with an investigation later discovering that the match had been fixed with four players implicated and later banned from all future official events – this led to some very quick changes in the way the trading system worked to make it more difficult for skin betting to occur, and following a lawsuit in 2016 the most popular site amongst players announced it would be ending its services, bringing an end to the website that had been suggested could generate up to $7.4 billion in cosmetic item value in that year.

There is something important to note with the way skin betting worked however, and may be a contributing factor to why many of the events were able to gain as much attention as they did and bring on a growing number of investors, including betting operators – the crowd funded nature of the prize pool. This was popularized in DoTA2, but had been successful in Counter-Strike too – as mentioned earlier in the report, DoTA2 in 2019 was able to build a prize pool of over $34 million through community contributions through the cosmetics market place, and whilst Counter-Strike was unable to generate as much in 2013 and 2014 where the cosmetic crates did offer this, it did in a sense encourage players to take part in obtaining these crates to open.

EMERGENCE OF REAL MONEY BETTING

Whilst 2016 signalled the end of the peak for skin betting, it did kickstart the movement to introduce a more familiar form of betting to the market as many of the bigger operators saw the interest and potential – keeping in mind that the $7.4 billion valuation for the cosmetic betting and gambling market was the figure attributed to just one game, and with a growing number of others gaining traction such as League of Legends and DoTA2 at a similar time.

As 2016 drew to a close, many fans were seeing how much more reliable real money betting within Esports had become and the bigger operators began to realise the true potential, and 2017 really ushered in the change – more titles were added to the betting cycle outside of the big three games previously mentioned, many more events were also being represented as official and community events would be opened up for punters with all of the information needed, and the legal grey area that skin betting was able to operate under was quickly replaced by a legitimate and trusted service with many of the bigger names in the industry getting on board.

The big change had largely come with sponsorship involvement in bigger events and with the teams themselves, as seen across other sports many betting operators were quick to start sponsoring major events and individual teams increasing awareness of their involvement within Esports with some even getting what would essentially be prime time spots on analysis parts of the broadcast during every game – even with a huge amount of support the early betting industry was still quite small however. Numbers at the time were quite conservative – but they did tally up quite nicely given the market was still seeing tremendous growth. In 2016, it had been predicted that the Esports revenue number was just shy of one billion, sitting at an estimated $892.4m, with the betting market being much smaller at just $58.9m – smaller even than the prize pools that were offered throughout the year which totalled $78.3m – for contrast the total prize money in esports had increased to $228.8 million in 2019, just three years later.

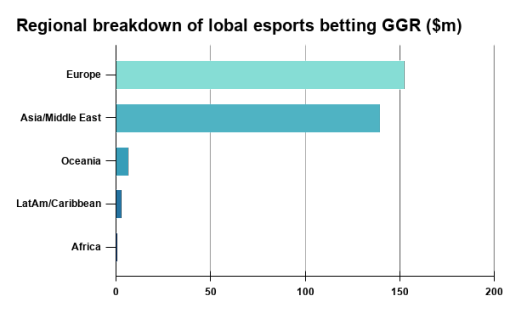

CURRENT ESPORTS BETTING

Things have changed very quickly since 2016 however and the current esports betting market is enormous – the global esports betting market in 2020 has been forecasted to reach $23.5 billion by the end of 2020. It is often difficult to get a completely accurate figure for this too and the number could in fact be much higher – as with viewership, the audience split falls heavily in to two regions. The western audience which incorporates Europe, the US, as well as including other regions such as the Oceanic region are often the numbers that are followed, but in certain games in particular the Eastern market primarily consisting of China and South Korea are enormous, and where larger viewership and betting numbers are quoted it is often suspected that numbers are much larger in the East.

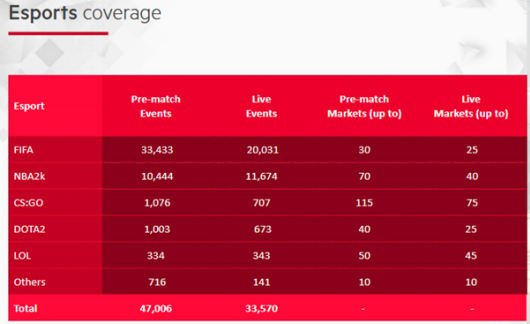

Whilst the big three continue to be the most best esports events currently, there are suggestions that other titles which fill a more normal genre are starting to catch up. The two biggest by far are in both FIFA, and the NBA2K League. FIFA has been finding widespread success for a number of years – the gameplay is simple for enthusiasts and the casual viewer alike, and to those who may not have been an esports viewer previously, it provides some level of familiarity. NBA has also found success here for similar reasons, but also had a bit of an advantage as it has been directly supported and endorsed by the NBA.

It’s difficult in some measure to judge the success of either, neither are able to generate the same interest through viewership as previously mentioned titles do, but their successes may instead be found in the fact that they have been able to generate viewership from a more casual audience that may not have been interested in esports prior, and also allowing these casual fans to place bets on something that’s a little more comfortable for them.

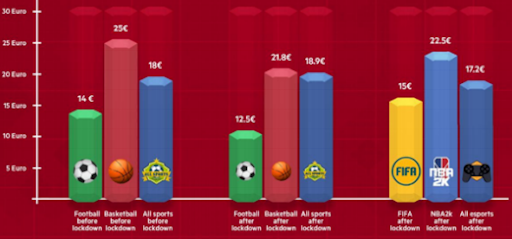

This same period of time also saw the average betting value rise – whilst betting as a whole has seen an increase following the lockdown period ending, the numbers also suggest that esports betting average values are similar to what had been seen in traditional events pre-lockdown with further suggestions that up to 10% of those surveyed who were bettors on traditional sporting events prior to the lockdown had made the adjustment to esports betting, with 41% of those asked who weren’t bettors on any sport prior to lockdown now finding themselves betting on esports titles.

ESPORTS VIEWERSHIP

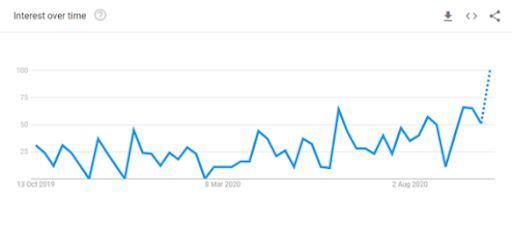

A good indicator of how successful esports betting can become is within the viewership numbers and how quickly they’re rising – perhaps the biggest esports title in the world is currently League of Legends which has a huge representation across every region in the world. Whilst these games currently can’t compete with other huge international events such as the Olympics or the World Cup, the figures are starting to beat out larger regional events. In 2019 figures suggest the Superbowl was able to capture around 99.4 million viewers, but the highest concurrent viewership was suggested to be around 3 million – for comparison, the 2019 League of Legends World Championship had been suggested to capture a similar maximum of around 100 million viewers, but the highest peak recorded concurrent viewership on the final day of the event had been a suggested huge 44 million. The ongoing currency World championship event could be set to break those records too, as early figures from the group stages look promising

Current trends show that as the worlds event moves forward, the interest in betting on games continues to increase too – whilst the group stages are usually viewed much less than the knockout and final stages, google trends suggest that interest in league of legends betting for example is certainly increased.

One of the more important statistics within esports is certainly within the viewership numbers too – it directly supports the investor and advertising interest and is what allows for the events to grow bigger. Betting operators took advantage of this early on – sponsoring a number of events and different teams meant that the name was out in the community as the services began to pop-up, and itself has had an impact on the success of the sites for many.

ONGOING PANDEMIC FIGURES

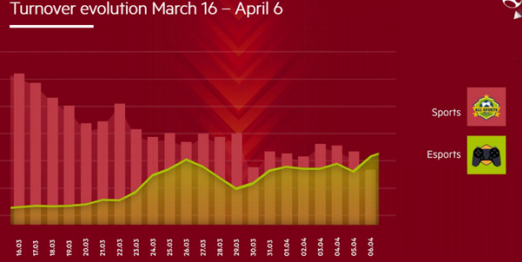

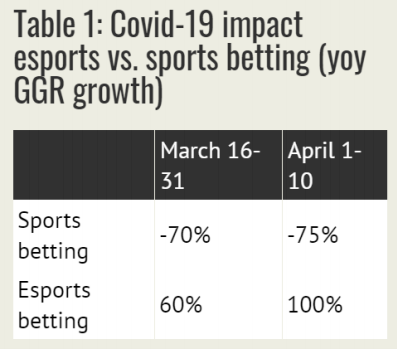

This year may have also seen a much sharper rise due to the ongoing global pandemic, where other sports were heavily impacted by cancellations and postponements many online events were able to continue – this also led to player numbers increasing as platforms such as Steam hit record numbers with a peak of 23 million users during the start of the pandemic in March.

Although the numbers aren’t directly tied to the esports betting market, it does show increasing interest in the games and platforms that are a huge part of esports. The increase in numbers wasn’t just for the gaming platforms themselves however as operators also reported an uptick – one betting platform Luckbox reported a 54% increase in new player registrants following the cancellation of the English Premier League in football at a similar time in March, and with the growing popularity in crossover games that offer more familiarity such as FIFA for football fans or NBA2K for basketball fans, esports betting is now becoming more accessible to growing numbers of players.

FUTURE FOR ESPORTS BETTING

There’s of course a lot of speculation around how much the betting market could change moving forward, but there are also a lot of variables that can change many of the predictions. A popular figure currently being floated is that the market could continue to increase it’s growth over the next four years and possibly generated up to $862m in revenue by 2024, but there are suggestions this could be much higher.

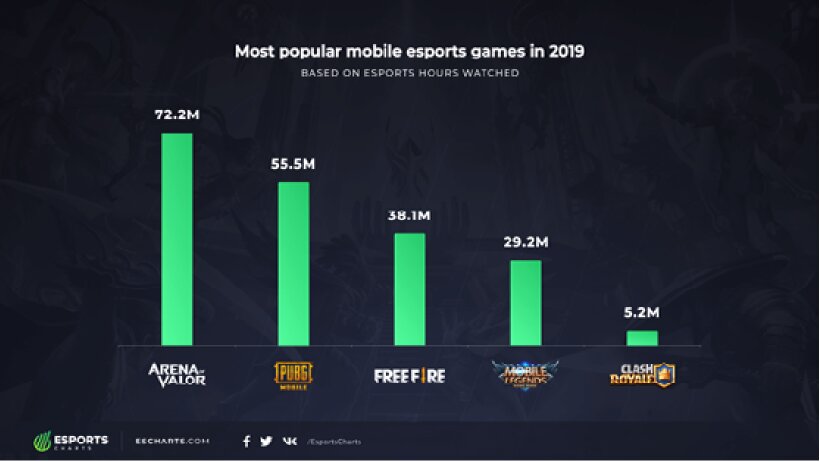

One factor that has been considered is the possible growth of esports on our mobile devices – the mobile gaming market now accounts for over 50% of all gaming across every platform and is still a bit of an untapped market in esports – whilst there are some titles, namely in the Battle Royale category that have gained popularity, the numbers are much lower than both the PC and console counter parts. There are some titles that are propping the numbers up however, continuing on the popularity of the MOBA genre, titles such as Arena of Valor had managed to rack up 72.2m hours of esports viewership, and the integration of a betting scene here could be of huge benefit to the mobile market.

Another factor to be considered is the launch of new titles that further wider the audience – this is something that has been seen recently with the release of Riot Games new title in Valorant which has been pegged as the next big entry in esports – whilst this game has been able to benefit from a crossover audience of two of the biggest titles in the world in League of Legends and Counter-Strike as the two audiences merge a little, it has shown that emerging games certainly have the potential to carve out their own audience.

ALTERNATIVE BETTING

One of the many benefits that has been brought to Esports has been within the alternatives of betting that have been formed within the games themselves – the most popular of these has been within an integrated fantasy styled league that has taken place in many of the bigger events. This has been introduced through the “Pick’ems” system, at the start of a big event players can opt in to make choices on the group and knockout stages of a tournament with varying prizes often being offered, this year for example see the League of Legends World Championship event offering a brand new gaming system for the winner, with the five million entrants in 2019 only finding a single player making perfect picks.

At first there had been a paid entry to these challenges, but many since have become free for all players to enter – early forms in games such as Counter-Strike even involved players requiring the team stickers which held a certain value to take part – it is still a relatively new form of betting on these games however, and is certainly something that will evolve over time.

CHALLENGES FOR ESPORTS BETTING

Despite the huge growth being seen, there are a number of challenges for the esports betting market as a whole – given the market is still so young there’s a lot of room for movement, and not all of that movement will be of benefit.

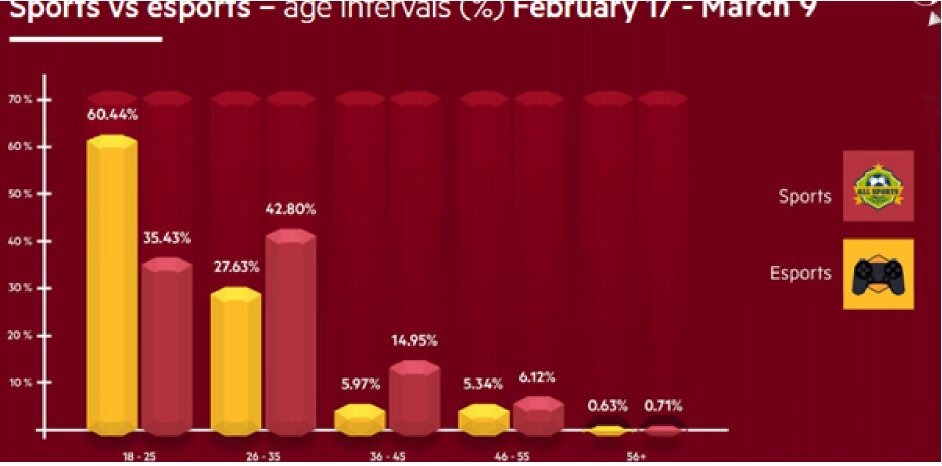

BETTING DEMOGRAPHICS

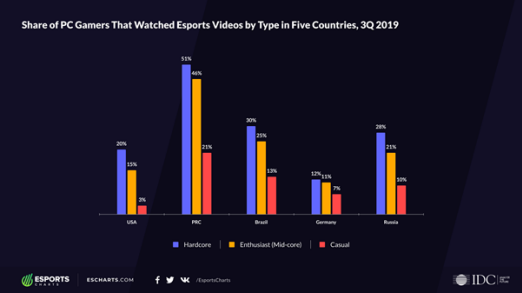

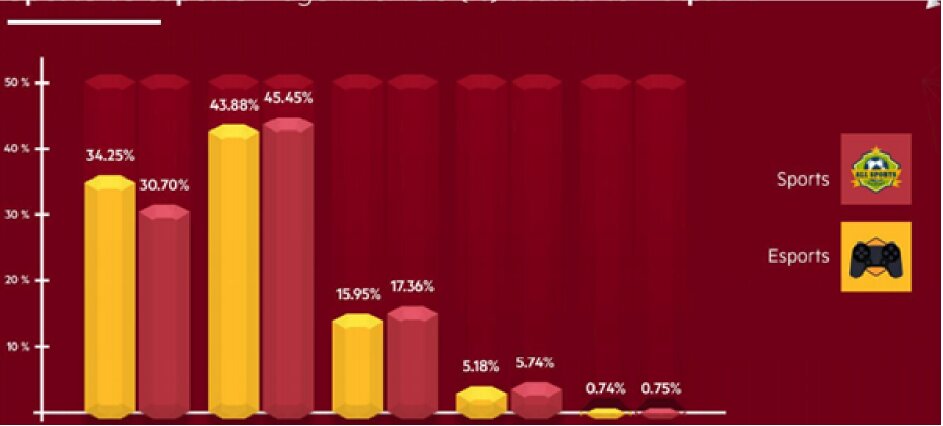

Across sporting, research suggests that that younger males are the primary audience for sports betting with up to 70% of core sports betting being represented by males, with 45% of those core bettors being between the ages of 23-34 – whilst this does support the growth of esports betting as a whole, it may be damaging to other markets. The previously mentioned possible growth of mobile betting is one area here that could be important – mobile gamers are primarily female gamers within the same age bracket, if they may be the primary audience for these titles given the platform then it may see numbers much lower than across other platforms.

REGULATION CHANGE

It’s also important to consider possible regulation adjustments that could have an impact of the market – in 2018 there had been an adjustment in the US which is one of the smaller markets for esports betting making adjustments to certain regulations that allowed for more operators to spring up, but it has seemingly had little impact on pushing numbers higher than they’re currently at. Similarly with increasing efforts to reduce participation options for younger players across Europe with gambling and betting in mind, there’s the possibility that some services could become restricted.

SUMMARY

All in all, esports betting is on a very successful path – when keeping in mind that the growth had only really started around four years ago, things have certainly come a long way for the bigger games that are represented within the market. It’s also possible to see the future successes as newer esports titles that have arrived over the past few months have managed to gain a large amount of traction and generate new interest for both existing fans, and the newer fans that have been gained over the course of the pandemic.

The advantages have been clear too – the ability for players to compete online has allowed for many events to continue without disruption where many other traditional sporting fixtures have had to either cancel or postpone in recent months – with both online and offline events not being so dependent on external forces changing the schedule, newer punters will benefit from the consistency and reliability of this still developing sport.